March 4, 2024

In a global context of increasing focus on sustainability, the European Union has embarked on an ambitious path of reforms in recent years, aiming to take the lead in the transition to a sustainable economic-financial system, demonstrating a strong commitment to achieving climate neutrality by 2050.

The approval and publication on December 16, 2022, in the Official Journal of the EU, of Directive No. 2022/2464 on corporate sustainability reporting, known as the Corporate Sustainability Reporting Directive (CSRD), within the context of the European Green Deal, represents a significant step. The CSRD amends the previous Non-Financial Reporting Directive (NFRD) of 2014, requiring member states to adopt it within 18 months of its publication, transforming the landscape of non-financial information disclosure.

The primary objective of the CSRD is to address the gaps identified in the NFRD, improving transparency and providing investors, analysts, consumers, and other stakeholders with clear and comparable information on companies' sustainability performance.

The transition to CSRD compliance will occur progressively starting in 2024, primarily guided by the legacy of the NFRD and company size.

The scope of companies involved in sustainability reporting will thus significantly expand. According to EU estimates, the number of companies currently preparing Non-Financial Statements will increase from 11,700 to approximately 50,000, including about 4,000 in Italy. Non-listed SMEs can also voluntarily report on their sustainability activities, as many are required to do so by clients according to Green Procurement practices. Additionally, the chain effect generated by the mechanism will require companies obligated to report to collect information from their entire supply chain.

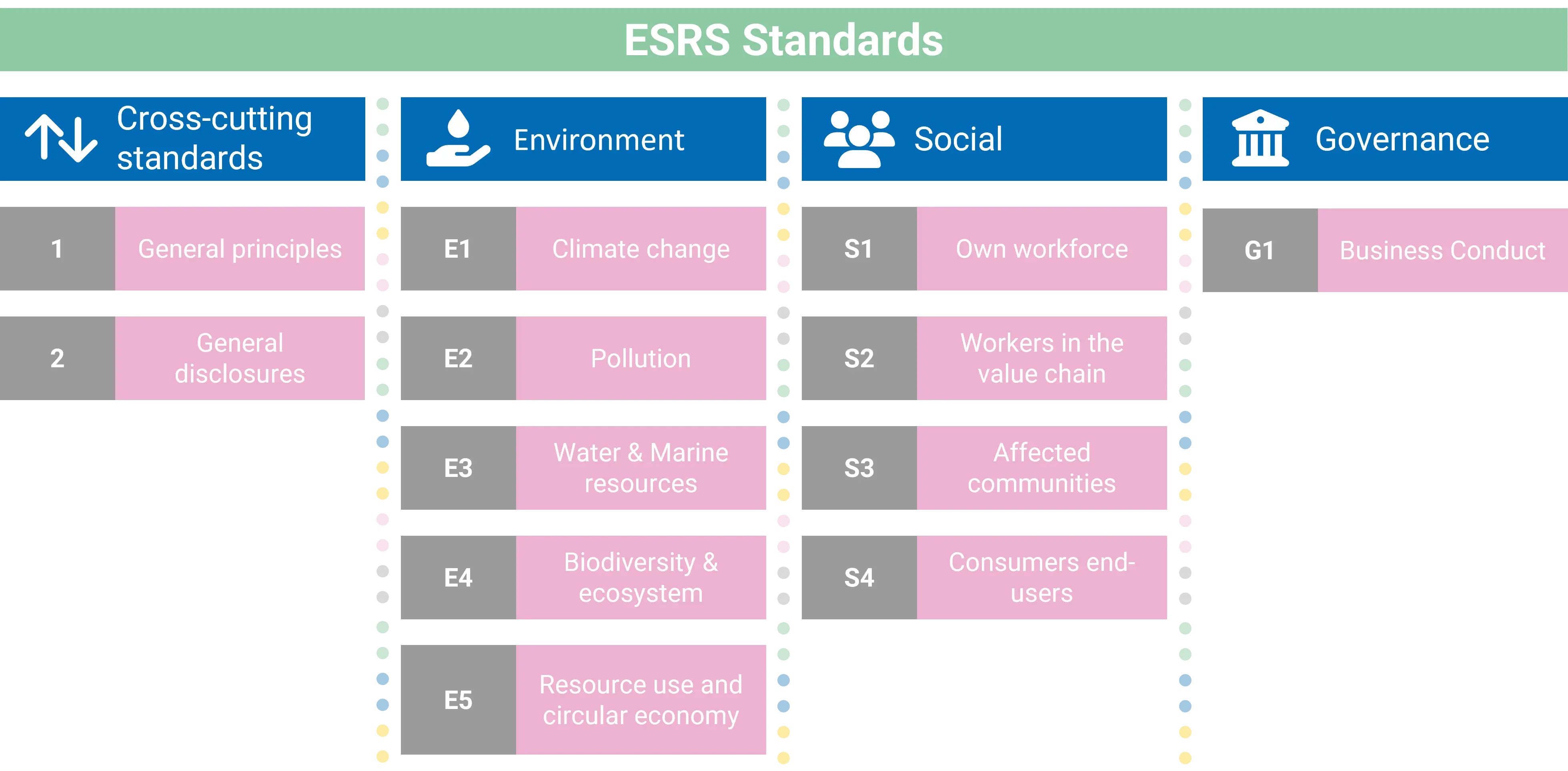

CSRD reporting is based on the new European Sustainability Reporting Standards (ESRS) issued by the European Financial Reporting Advisory Group (EFRAG) on behalf of the European Commission. These standards provide a detailed framework regarding the information companies must disclose. Such information is divided into cross-cutting, environmental, social, and governance categories.

The standards provide crucial information to investors to evaluate the sustainability impact of the companies they invest in. They are also developed considering contributions from the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI), ensuring a high level of interoperability between European and global standards and avoiding unnecessary duplication in company reports.

By June 30, 2024, the directive will be integrated by introducing sustainability reporting principles proportional and relevant to the capabilities and characteristics of small and medium-sized enterprises and the scope and complexity of their activities.

2024 will be a crucial year for companies aspiring to genuine sustainability.

The introduction of the CSRD and ESRS standards represents a significant step forward in sustainability reporting. These not only provide a clear and demanding regulatory framework for EU companies but also serve as a clear invitation for businesses to transform their corporate vision, embracing sustainability as an integral part of their DNA.

It will be interesting to see how companies embrace this challenge, and the hope is that sustainability will become increasingly central to business strategies.